washington state capital gains tax repeal

House Bill 1912 has been referred to the House Finance Committee. Vander Stoep backed by a committee registered with the state as Repeal the Capital Gains Income Tax In practice it would repeal SB 5096 signed into law last year and effective since January 2022 which created a 7 excise tax on the sale or.

Wa Budget Policy Budget Policy Twitter

A repeal vote advised the legislature to repeal a 7 tax on capital gains above 250000 with revenue allocated to education and child services which was passed in Senate Bill 5096 2021.

. Jay Inslee in 2021. The law imposes a 7 tax on capital gains above 250000 for individuals and joint filers from the sale of assets such as stocks and bonds. Vander Stoep has not disclosed its plans to the public but its aim appears to be to qualify a measure to the November 2022 statewide ballot that would completely repeal ESSB 5096 the popular 2021 law that levied a capital gains tax on the wealthy to fund early learning childcare and K-12 education.

Jeremie Dufault R-Selah has introduced legislation that would repeal the states new controversial capital gains income tax that went into effect on Jan. Repealing the capital gains income tax Last week a Douglas County Superior Court judge heard arguments in a lawsuit challenging the constitutionality of the capital gains income tax. This tax only applies to individuals.

Washington State Representative Jim Walsh R-Aberdeen issued the following statement on the Advisory Vote. The people with skin in the game are starting to play in the ballot initiative campaign to repeal Washingtons new capital gains tax. Exceptions include the sale of real estate.

The committee registered as Repeal the Capital Gains Income Tax has taken in the bulk of its funds from Columbia. Vander Stoep an attorney based in Chehalis who has been active in Republican politics for many years has filed the initial text of a measure that would completely repeal Engrossed Substitute Senate Bill 5096 the legislation that created Washingtons new state capital gains tax on the wealthy and dedicated the revenue it generates to childcare early learning. The latest filing to the Public Disclosure Commission from Repeal the Capital Gains Income Tax the committee behind Initiative 1929 shows it took in 211500 in cash during March along with 420000 in pledged donations that.

Voters responded to a nonbinding advisory question on the Nov. 1 day agoWashington Gov. The Washington Repeal Capital Gains Tax Initiative may appear on the ballot in.

The political action committee behind an initiative to repeal Washingtons capital gains tax has continued to rake in funds from wealthy donors having now brought in over 211000 with another 440000 in pledged contributions. As expected the I-1929 capital gains tax repeal campaign officially filed a legal challenge yesterday to the Attorney Generals ballot title and summary for the proposed ballot measure. Former Washington Attorney General Rob McKenna made compelling arguments that seemed to resonate with Judge Brian Huber.

4 hours agoThe Center Square The Initiative 1929 campaign to repeal Washington states nascent capital gains tax is legally challenging what it calls the Office of the Attorney Generals misleading ballot title and summary for the proposed. Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session. The people with skin in the game are starting to play in the ballot initiative campaign to repeal Washingtons new capital gains tax.

The state of Washington enacted a capital gains tax on individuals who recognize gain from the sale of long-term capital assets. The legislation placed a 7. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021.

1 day agoThe political action committee behind an initiative to repeal Washingtons capital gains tax has continued to rake in funds from wealthy donors having now brought in over 211000 with another. 2 statewide ballot with 63 in favor of repealing the tax and 37 in favor of maintaining it the state elections office reported late Tuesday. Jay Inslee signed into law Senate Bill 5096 enacting a capital gains tax on the sale of long-term capital assets of individualsThe new tax has the potential to dramatically change Washingtons tax structure as the state does not impose an income tax on either businesses or individuals.

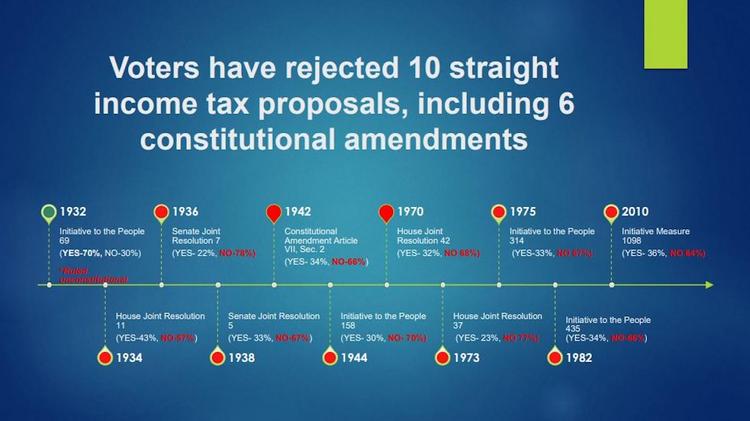

The AGs proposed language referred to the capital gains tax as an excise tax despite a court ruling unequivocally agreeing with the IRS and the. The committee helmed by longtime Republican operative J. Washingtonians have told us several times over the years they do not want any form of a state income tax.

Washington state voters overwhelmingly voted to disapprove of an excise tax on capital gains that takes effect in 2022. The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year where the profit exceeds 250000 annually. The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights.

The initiative was filed Monday night by Chehalis attorney J. On May 4 2021 Washington state Gov. Thats interesting because it only bails out the.

The answer from voters by a wide margin was no with a vote of 63 to 37. The latest filing to the Public Disclosure Commission from Repeal the Capital Gains Income Tax the committee behind Initiative 1929 shows it took in 211500 in cash during March along with 420000 in pledged donations that. Court battle over capital gains tax could rewrite Washingtons tax code.

At issue is the statewide capital gain tax approved by the legislature and signed by Gov. Jay Inslee speaks before signing a bill into law in Tukwila Wash Tuesday May 4 2021 that levies a new capital gains tax on high profit stocks bonds and other assets for some residents of Washington state. First of all its just a straight-up repeal meaning that it would scrub Washington law of all mention of Senate Bill 5096 from last year eliminating the 7 percent tax on most capital gains over 250000 which is expected to bring in about 500 million per year when its fully implemented¹.

Under a 2007 state law voters must be.

Judge Overturns Washington State S New Capital Gains Tax Lynnwood Times

I 200 Remains But State And Local Leaders Reveal Impacts To Keep The Fight To Overturn Alive South Seattle Emerald

Amid Court Battle Over Capital Gains Tax House Finance Chair Previews Future Reforms Publicola

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

Washington Doesn T Need A Capital Gains Tax Vancouver Business Journal

Washington State Senate Democrats Unveil Budget Proposal Big Boost In Spending Capital Gains Tax Northwest Public Broadcasting

Washington State Capital Gains Tax Update Attorney General Seeks Appeal To Reinstate Controversial Law Geekwire

Like Hollywood Washington State Can T Resist Its Sequels Puget Sound Business Journal

Public Weighs In On A Simple Majority For School District Bonds Washington State Wire

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Kuow Lawsuit Filed To Overturn Washington Capital Gains Tax

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Mixed Results For Progressives In 2022 Legislative Session Mar 30 Apr 5 2022 Real Change

New Payroll Tax In Washington State Merriman

Judge Strikes Down Capital Gains Tax Washington State Wire

:quality(70)/d1hfln2sfez66z.cloudfront.net/10-07-2021/t_25d6a9fc0f48401fb4bc03335d1c699c_name_file_960x540_1200_v3_1_.jpg)

Video Efforts To Repeal Washington S Capital Gains Tax Underway Kiro 7 News Seattle

Like Hollywood Washington State Can T Resist Its Sequels Puget Sound Business Journal

Washington State Senate Democrats Unveil Budget Proposal Big Boost In Spending Capital Gains Tax Northwest Public Broadcasting

Washington State Kicks Off Major Tax Fight With New Capital Gains Levy The Hill